Communities worldwide are reimagining financing by moving away from burdensome loans toward models that generate ongoing returns. This article explores how collective ownership of regenerative assets can yield sustainable dividends and build resilient local economies.

Traditional financing methods for community projects rely heavily on bank loans, municipal bonds, and mortgages, which often saddle local stakeholders with long-term repayment obligations. While debt can jumpstart development, it introduces risk and limits the capacity to adapt to evolving needs.

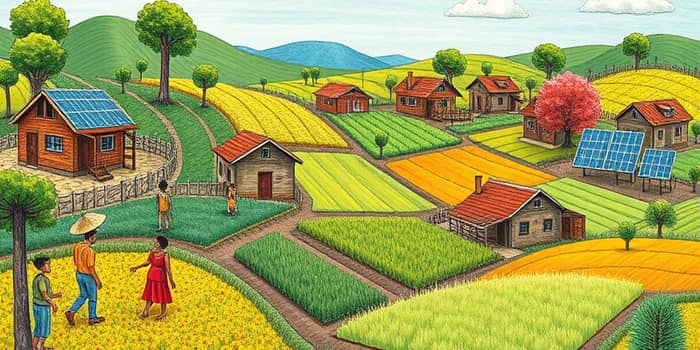

By contrast, dividend-based structures transform assets into revenue-generating engines. Rather than repaying financiers, communities receive returns in the form of profit disbursements, ecosystem services, or social benefits. This paradigm creates a cycle of reinvestment and empowerment, aligning financial incentives with ecological health.

Several innovative structures facilitate the transition from debt-heavy approaches to dividend-oriented strategies. These models balance risk, community control, and yield generation.

By integrating these structures, communities mitigate exposure to high-interest debt while retaining operational control and securing reliable income streams.

Real-world examples demonstrate how dividend-centric models generate ecological, economic, and social returns. The following table highlights key characteristics across leading projects.

Farmland LP manages over two hundred million dollars in assets, distributing dividends to both institutional and retail investors. Agrarian Trust pools local contributions to secure farmland, placing it in legal commons structures. Athens Land Trust integrates housing with agriculture, reinvesting revenue into youth development and conservation. The Ecology Center operates as a community hub, where educational programming and food sales generate shared prosperity.

Major corporations and municipal entities are also embracing regenerative dividends to meet sustainability goals and foster inclusive growth. These partnerships often provide capital, expertise, and market access.

Examples include:

These alliances blend corporate resources with local knowledge, catalyzing large-scale transitions while ensuring benefits flow directly to community members.

Transitioning to dividend-based financing is not without challenges. Communities often face legal complexities, limited access to flexible capital, and gaps in technical expertise.

Key enablers include supportive municipal policies, tailored grant programs, community foundations, and capacity-building initiatives. Integrating advisory services with funding platforms helps bridge knowledge gaps, while innovative legal structures simplify collective ownership arrangements.

Regenerative assets deliver multifaceted value that extends well beyond financial payouts. When communities collectively steward land and infrastructure, they harvest a spectrum of dividends:

Ecological dividends such as improved soil fertility, biodiversity enhancement, and carbon sequestration;

Social dividends including food security, affordable housing, health benefits, and educational opportunities;

Economic dividends manifested in stable income streams, job creation, and asset appreciation that accrues to local stakeholders rather than distant creditors.

By capturing these diverse returns, communities build resilience against economic shocks, mitigate environmental degradation, and cultivate a sense of shared purpose. Regenerative assets become living legacies, passing value across generations.

The movement from debt to dividend represents a profound reorientation of how communities finance their collective futures. By prioritising models that generate sustainable yields, local stakeholders reclaim agency, foster ecological regeneration, and unlock equitable wealth creation.

As practitioners, policymakers, and investors embrace this paradigm, the proliferation of community-owned regenerative assets will accelerate. Through collaboration, robust legal frameworks, and innovative capital structures, communities can transform liabilities into living dividends—cultivating ecosystems, economies, and cultures that thrive in harmony.

Ultimately, the journey from debt to dividend is not merely a financial shift; it is a testament to the power of collective action and regenerative hope.

References