In a world where urgent crises demand immediate attention, a quieter revolution is unfolding—one that champions the patient deployment of capital to heal and renew our planet. Long-term investments that prioritize regeneration are emerging as a powerful force for systemic change. This approach transcends conventional profit metrics, seeking instead to restore ecosystems, empower communities, and build resilience for generations to come.

By embracing capital that mirrors nature’s own rhythms, investors can spark transformative cycles of renewal rather than extractive practices that deplete resources. This article explores how patient capital unlocks regenerative investing, offering practical insights, real-world examples, and guidance for those eager to align their portfolios with lasting planetary health.

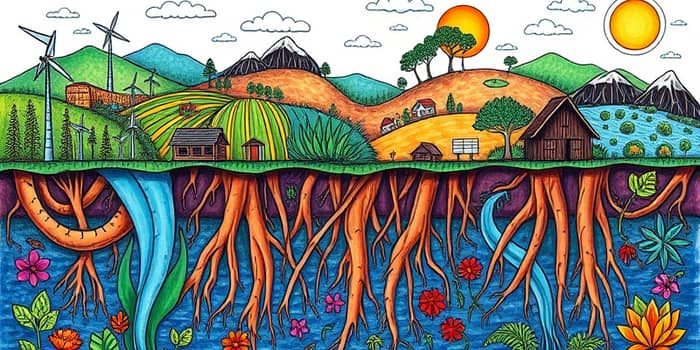

Regenerative investing moves beyond minimizing harm—it actively enhances ecological and social systems. Restores, enhances, renews systemic impact marks its fundamental distinction from both conventional and ESG approaches.

Conventional investing focuses on short- to medium-term financial returns, often ignoring externalities. Sustainable or ESG investing integrates environmental, social, and governance criteria to reduce negative impact. Regenerative investing, however, seeks to generate positive feedback loops that bolster biodiversity, improve livelihoods, and strengthen community networks.

At its heart, regenerative investing operates on a foundation of interconnectedness and stewardship. Five core principles guide practitioners:

Patient capital flows into sectors where regeneration can yield profound benefits, both ecological and economic.

For instance, agrovoltaics integrate solar panels with crop production, simultaneously boosting yields and ecological function. In 2024, nearly half of regenerative financing assets were dedicated to farmland and food systems, underscoring the sector’s pivotal role.

Traditional financing often imposes rigid repayment terms misaligned with the slow pace of ecological recovery. Patient capital introduces creative vehicles:

These instruments empower projects like Oshala Farm in the U.S., where a patient loan freed farmers from crushing annual repayments, allowing them to reinvest in soil regeneration and biodiversity.

Success in regenerative investing demands metrics beyond GDP or narrow ROI. Practitioners evaluate a tapestry of capitals:

Resilience and adaptability are key indicators. Investors track adaptive capacity—how well communities and ecosystems absorb shocks, innovate, and thrive. Outcome data from initiatives like Sea Ranger Service reveal positive emergent properties: increased fish stocks, restored habitats, and stable employment in coastal regions.

Despite rising interest from pension funds and family offices, regenerative investing faces hurdles:

Bridging these gaps requires collaborative financial models. Blended finance, concessional loans, and guarantees can attract a broader pool of capital by sharing risk and layering returns. Cultivating partnerships between investors, NGOs, governments, and indigenous communities will be essential to scale impact.

Several pioneering projects illuminate the regenerative path:

These examples demonstrate how aligning capital time horizons with natural cycles yields thriving, resilient systems that benefit all stakeholders.

Regenerative investing offers a vital paradigm shift—investing in restoration, not mere maintenance. By deploying patient capital, we can finance true system regeneration, fostering a world where economies and ecosystems flourish together.

The question facing investors and policymakers is clear: can we evolve financial models and mindsets quickly enough to confront the climate and biodiversity crises? Embracing long-term regenerative strategies may well be the most powerful tool in our collective arsenal for a healthier, more equitable planet.

References