In an era defined by ecological crises and social inequities, investors face a pivotal choice: continue the extractive status quo or embrace an approach that nurtures both planet and people. positive social and environmental outcomes signal a new paradigm, one where capital becomes a tool for healing and abundance.

This comprehensive guide unpacks the theory, principles, practices, and metrics of regenerative investing—arming you with actionable insights to drive transformative change.

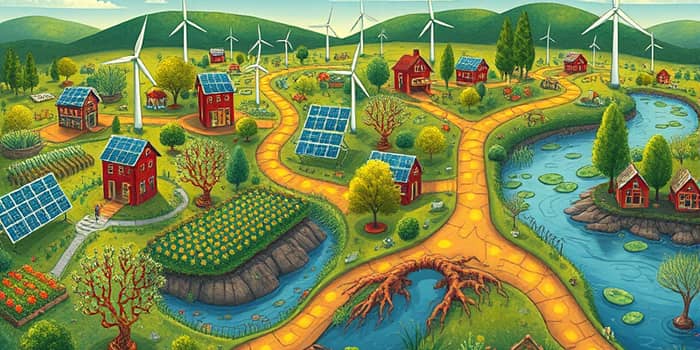

Regenerative investing transcends conventional sustainability by aiming to restore, renew, and enhance the capacity of natural and social systems. It considers investors, investees, and their socio-economic-ecological contexts as an integrated whole.

Rather than merely maintaining equilibrium, this approach actively repairs degraded landscapes, revitalizes communities, and builds resilience against future shocks. By shifting from extraction to regeneration, investors can catalyze multi-dimensional value creation across generations.

Several leading organizations articulate guiding pillars for regenerative finance:

The Regenerative Investing Institute highlights three pillars: realizing business potential, expressing business citizenship, and developing regenerative capabilities.

The Capital Institute’s eight principles—ranging from right relationships to edge effect abundance—underscore the need for innovation, circular energy flows, and honoring community and place.

Across frameworks, common themes emerge: systems thinking, long-term perspective, holistic impact, circular economy, community-centric approaches, transparency, resilience, and inclusivity.

Investors are encouraged to adopt prioritize collaboration over competition and profit as a guiding mindset, ensuring decisions respect ecological boundaries and social equity.

Regenerative strategies manifest differently across industries but share the goal of creating positive feedback loops:

Adopting these practices helps build soil carbon, improve water retention, boost biodiversity, and foster economic opportunities for marginalized groups.

Robust metrics are essential to demonstrate success and guide continuous improvement. Key categories include:

By focusing on long-term system health and resilience, investors can internalize externalities and build trust with stakeholders through transparent, integrated reporting.

Real-world examples illuminate the power of regenerative capital:

The Sea Ranger Service secures impact-first funding to restore coastal ecosystems and train veteran rangers in marine conservation.

Voelkel Juice sources from organic farms using regenerative value chains, boosting biodiversity and farmer incomes simultaneously.

GLS Bank’s stakeholder-driven round tables address supply chain challenges, ensuring fair practices and environmental stewardship at every step.

Barriers to scaling regenerative investing include entrenched extractive mindsets, short-term performance pressures, and inconsistent pricing of ecological benefits. Yet, a equitable, adaptive, and inclusive decision-making ethos can dismantle these obstacles.

Investors must cultivate humility, learn from living systems, and remain open to evolving strategies. prioritize collaboration over competition and profit transforms capital into a catalyst for systemic restoration.

Deepen your practice with leading frameworks, networks, and certifications:

Armed with this toolkit, regenerative investors are poised to generate abundant returns—in financial, social, and ecological terms—while building a more resilient and equitable future.

References